The study of public finance and monetary systems relies heavily on academic literature to establish theoretical frameworks, empirical evidence, and policy implications. English-language references are particularly crucial due to their global influence and the widespread adoption of methodologies from Western scholarship. This overview categorizes key references in public finance and monetary economics, highlighting seminal works, contemporary research, and essential resources for students and researchers.

In public finance, foundational texts often explore the role of government in the economy, taxation, and public expenditure. Richard A. Musgrave’s The Theory of Public Finance (1959) remains a cornerstone, introducing the three functions of government: allocation, distribution, and stabilization. For empirical analysis of taxation, James M. Poterba’s Taxation and Housing (1984) in the American Economic Review examines how tax policies influence housing markets, providing a model for linking fiscal policy to microeconomic behavior. More recent work, such as Emmanuel Saez’s Using Elasticities to Derive Optimal Income Tax Rates (2001), applies optimal tax theory to real-world policy, emphasizing trade-offs between equity and efficiency.

Public expenditure and its effectiveness are another critical area. Abhijit V. Banerjee and Esther Duflo’s Poor Economics (2011), though not strictly academic, synthesizes randomized controlled trials (RCTs) to evaluate social spending, influencing evidence-based policy. For a technical perspective, David N. Hyman’s Public Finance: A Contemporary Application of Theory to Policy (2025) bridges theory and practice, discussing topics like healthcare and education spending.

In monetary economics, the focus shifts to central banking, money supply, and financial stability. Milton Friedman and Anna Schwartz’s A Monetary History of the United States, 1867–1960 (1963) revolutionized the field by arguing that monetary policy was the primary driver of economic fluctuations, particularly the Great Depression. Frederic S. Mishkin’s The Economics of Money, Banking, and Financial Markets (2025) is a comprehensive textbook covering modern monetary theory, financial intermediation, and the role of central banks in crises.

Post-2008 research has emphasized financial stability and unconventional monetary policy. Claudio Borio’s The Financial Cycle and Macroeconomics: What Have We Learnt? (2012) in the Journal of Banking & Finance analyzes the link between credit cycles and economic instability, advocating for macroprudential policy. For central bank communication, Michael Woodford’s Methods of Policy Accommodation at the Interest-Rate Lower Bound (2012) explores the effectiveness of forward guidance in zero-interest-rate environments.

Empirical studies often employ econometric techniques to test monetary theories. For example, Christopher A. Sims’ Macroeconomics and Methodology (1996) advocates for vector autoregression (VAR) models to analyze monetary shocks, while John B. Taylor’s Discretion versus Policy Rules in Practice (1993) introduced the Taylor Rule, a guideline for central banks to set interest rates.

Cross-cutting themes include the interaction between fiscal and monetary policy, particularly in emerging markets. Reza Vaez and Ali Kutan’s Fiscal and Monetary Policy Interactions in Emerging Markets (2025) examines how coordination (or lack thereof) affects inflation and growth. For digital currencies, a emerging topic, Benoît Cœuré’s Central Bank Digital Currencies: Design Principles and Balance Sheet Implications (2025) discusses the technical and policy challenges of CBDCs.

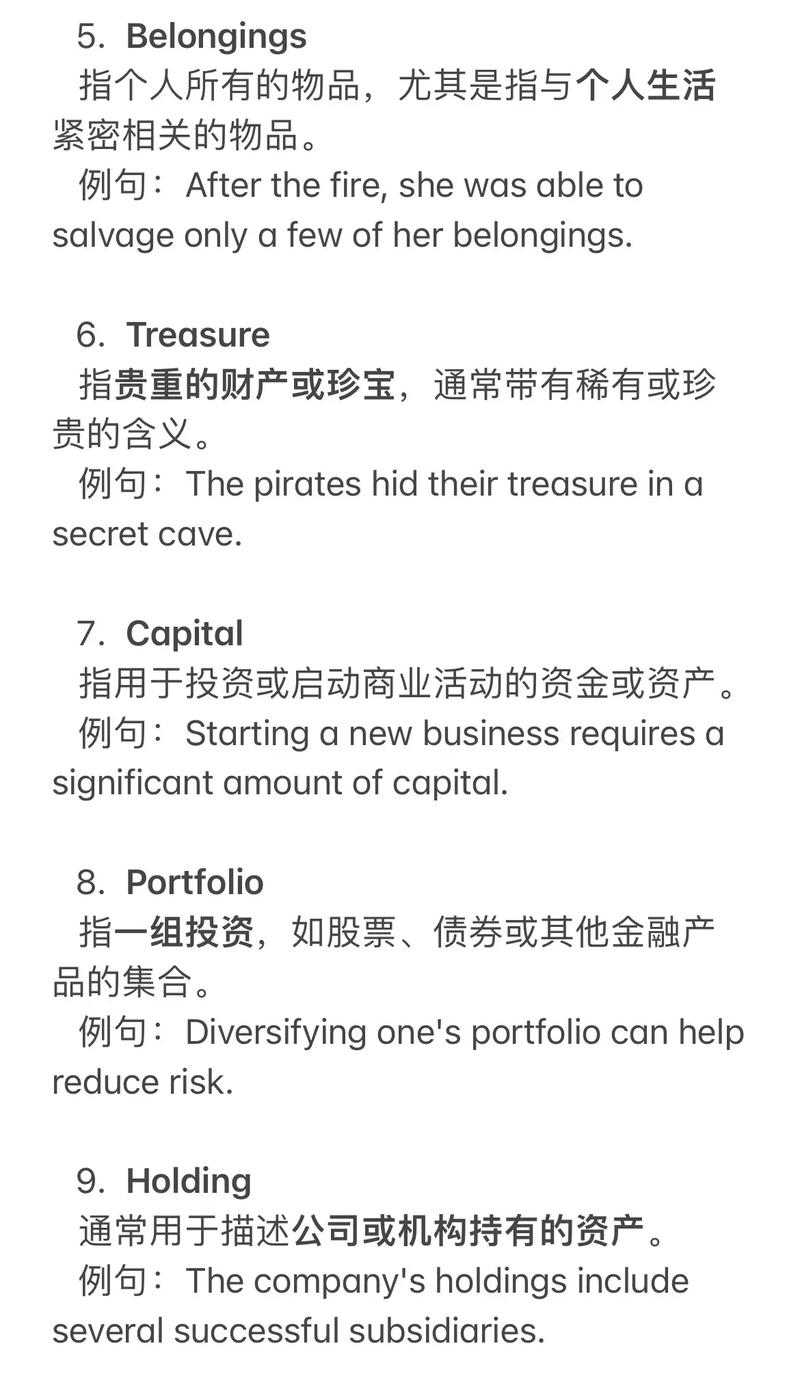

The following table summarizes key references across subfields:

| Subfield | Author(s) | Title/Work | Year | Contribution |

|---|---|---|---|---|

| Public Finance | Richard A. Musgrave | The Theory of Public Finance | 1959 | Established core functions of government finance. |

| Taxation | James M. Poterba | Taxation and Housing | 1984 | Analyzed tax policy impacts on housing markets. |

| Optimal Tax Theory | Emmanuel Saez | Using Elasticities to Derive Optimal Income Tax Rates | 2001 | Linked elasticity to optimal tax design. |

| Monetary Economics | Milton Friedman & Anna Schwartz | A Monetary History of the United States | 1963 | Demonstrated monetary causes of the Great Depression. |

| Central Banking | Frederic S. Mishkin | The Economics of Money, Banking, and Financial Markets | 2025 | Comprehensive textbook on monetary systems. |

| Financial Stability | Claudio Borio | The Financial Cycle and Macroeconomics | 2012 | Linked credit cycles to macroeconomic instability. |

| Monetary Policy | John B. Taylor | Discretion versus Policy Rules in Practice | 1993 | Proposed the Taylor Rule for interest rates. |

| Fiscal-Monetary Interaction | Reza Vaez & Ali Kutan | Fiscal and Monetary Policy Interactions in Emerging Markets | 2025 | Analyzed policy coordination in emerging economies. |

For researchers, databases like JSTOR, EconLit, and Google Scholar are indispensable for accessing these works. Additionally, working papers from institutions like the National Bureau of Economic Research (NBER) and the Centre for Economic Policy Research (CEPR) provide cutting-edge research ahead of publication.

FAQs

-

What are the key differences between public finance and monetary economics?

Public finance focuses on government revenue (taxation), expenditure, and their economic impacts, such as income redistribution and resource allocation. Monetary economics, by contrast, studies money supply, interest rates, central banking, and financial markets, examining how monetary policy influences inflation, unemployment, and economic growth. While public finance deals with fiscal policy (government budgetary decisions), monetary economics centers on monetary policy (central bank actions). -

How do recent trends like digital currencies impact the study of monetary economics?

Digital currencies, particularly central bank digital currencies (CBDCs), are reshaping monetary economics by introducing new forms of money outside traditional banking systems. Research now explores CBDCs’ implications for monetary transmission, financial inclusion, and payment efficiency. For example, a CBDC could enhance central banks’ ability to implement negative interest rates or directly distribute stimulus, but it also raises concerns about privacy and bank disintermediation. Scholars like Benoît Cœuré (2025) emphasize the need for robust design frameworks to balance innovation with stability.